Higher Education Loans Board (HELB) Financing Options For Kenyan Students is a crucial aspect of education financing in Kenya.

Editor's Note: Higher Education Loans Board (HELB) Financing Options For Kenyan Students published on [Date] is an essential guide for Kenyan students seeking financial assistance for their higher education. In this article, we explore the various financing options offered by HELB, their eligibility criteria, application procedures, and the benefits of utilizing these options.

We have analyzed and compiled information from various sources to provide a comprehensive guide on Higher Education Loans Board (HELB) Financing Options For Kenyan Students. Our aim is to empower students with knowledge and insights that will aid them in making informed decisions regarding their higher education financing.

Key differences or Key takeaways are provided in the table below.

Transition to main article topics.

FAQ

This section addresses frequently asked questions (FAQs) about Higher Education Loans Board (HELB) financing options for Kenyan students Higher Education Loans Board (HELB) Financing Options For Kenyan Students.

The Higher Education Loans Board (HELB) Can Now Disburse Loans Via M - Source www.femmehub.com

Question 1: Am I eligible for HELB financing?

Answer: To be eligible, you must be a Kenyan citizen or a permanent resident, enrolled in an accredited public or private university in Kenya, and meet the Kenya Universities and Colleges Central Placement Service (KUCCPS) placement requirements.

Question 2: What types of loans does HELB offer?

Answer: HELB provides two main loan schemes: the Higher Education Loans Scheme (HELS) for undergraduate students and the Postgraduate Loans Scheme (PLS) for postgraduate students.

Question 3: How much can I borrow through HELB?

Answer: The loan amount varies depending on the course of study and the institution attended. For HELS, the maximum amount ranges from Ksh 50,000 to Ksh 150,000 per year, while for PLS, it ranges from Ksh 200,000 to Ksh 400,000 per year.

Question 4: When do I start repaying my HELB loan?

Answer: Repayment typically begins one year after completing your studies or six months after securing employment, whichever comes first.

Question 5: What happens if I fail to repay my HELB loan?

Answer: Failure to repay your HELB loan may result in penalties, legal action, and negative credit reporting.

Question 6: How can I apply for HELB financing?

Answer: Applications are typically made online through the HELB website or at HELB offices. Deadlines and specific requirements vary, so it's advisable to check the HELB website for the most up-to-date information.

For more information on HELB financing options, visit the official HELB website.

Tips for Applying for Higher Education Loans Board (HELB) Financing

The Higher Education Loans Board (HELB) provides loans to Kenyan students to cover the cost of tuition, accommodation, and other expenses. To increase your chances of obtaining HELB financing, consider the following tips:

HELB Platform - New Experience - Create - Higher Education Loans Board - Source create.guru

Tip 1: Apply early.

The HELB application process is competitive, so it is important to apply as early as possible. The application deadline is typically in April each year. Early applications are more likely to be processed and approved before the funds run out.

Tip 2: Submit a complete application.

Make sure to complete all sections of the HELB application form and provide all required documentation. Incomplete applications will not be processed.

Tip 3: Meet the eligibility criteria.

To be eligible for HELB financing, you must be a Kenyan citizen, have a valid national ID card, and be enrolled in an accredited university or college. You must also meet the minimum academic requirements set by HELB.

Tip 4: Get a guarantor.

All HELB loans must be guaranteed by a creditworthy guarantor. The guarantor must be a Kenyan citizen with a good credit history.

Tip 5: Be prepared to repay your loan.

HELB loans must be repaid after you graduate from university. Start making payments as soon as possible to avoid accumulating interest and penalties.

Summary of key takeaways or benefits:

- Applying early increases the chances of getting approved.

- Submitting all required documentation ensures a smooth application process.

- Meeting the eligibility criteria is crucial for loan approval.

- Getting a guarantor with a good credit history is essential.

- Being prepared to repay the loan after graduation is vital.

By following these tips, you can increase your chances of obtaining HELB financing and pursuing your higher education goals.

Higher Education Loans Board (HELB) Financing Options For Kenyan Students

Higher Education Loans Board, commonly known as HELB, serves as a primary financial aid provider for Kenyan students seeking higher education. Its diverse financing options tailor to the unique needs of students, ensuring equitable access to quality education.

- Loans: HELB offers loans to cover tuition fees, accommodation, and living expenses at accredited institutions.

- Grants: Certain students from disadvantaged backgrounds receive non-repayable grants to support their studies.

- Scholarships: Meritorious students can access scholarships that cover full or partial tuition fees based on academic performance.

- Bursaries: Needy students may receive bursaries to cater for their tuition fees or living expenses.

- Repayment Plans: Flexible repayment plans allow graduates to repay their loans conveniently over an extended period.

- Loan Forgiveness: Under specific conditions, such as working in certain professions, graduates may qualify for loan forgiveness.

HELB's financing options empower Kenyan students to pursue their educational aspirations. The loans and grants ensure financial support for tuition and living expenses, while scholarships and bursaries recognize academic excellence and support disadvantaged students. Flexible repayment plans and loan forgiveness provisions cater to graduates' financial situations, making higher education accessible to a broader spectrum of students.

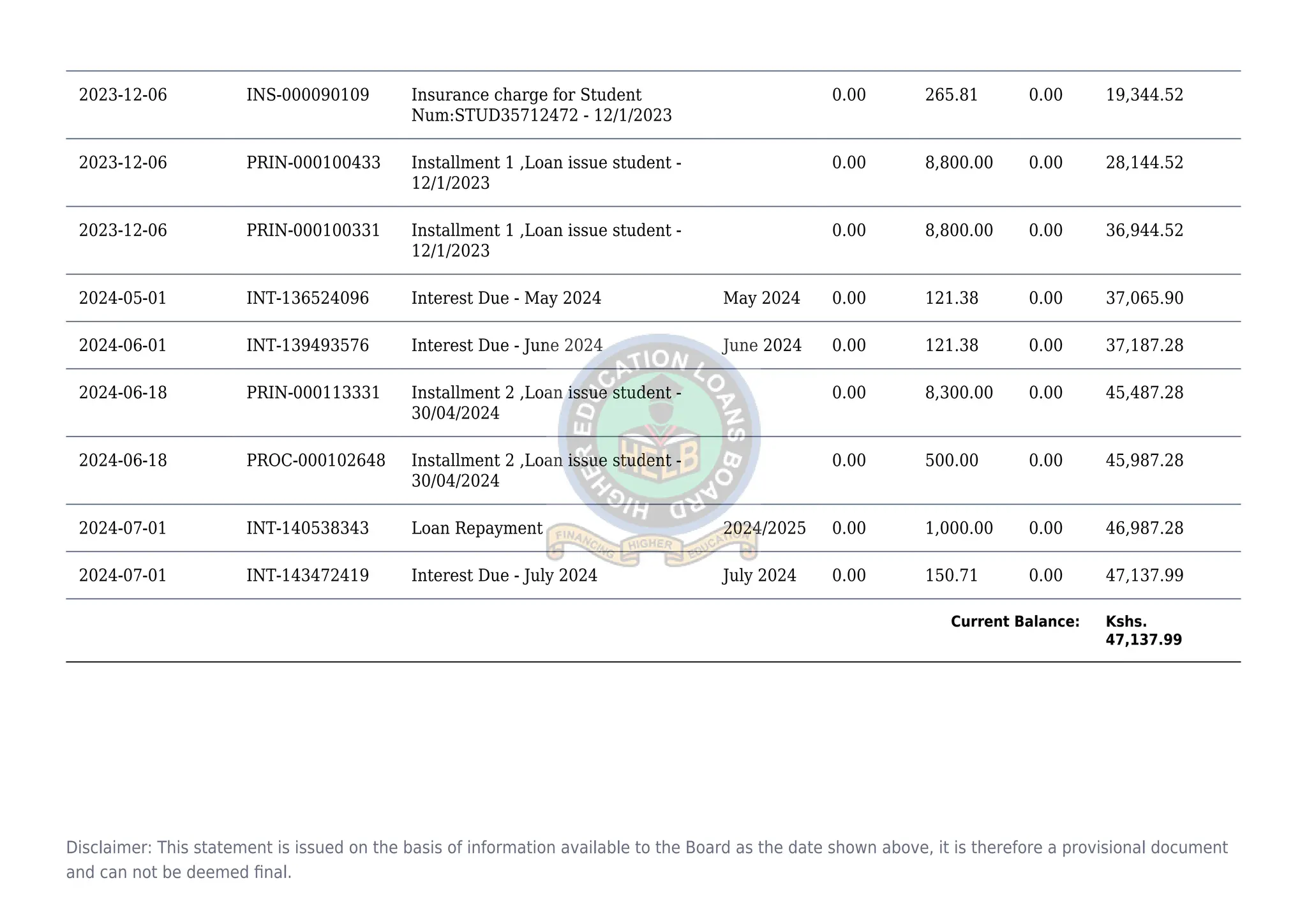

HELB Loan statement.pdf of higher education | PPT | Free Download - Source www.slideshare.net

Higher Education Loans Board (HELB) Financing Options For Kenyan Students

The Higher Education Loans Board (HELB) offers various financing options to support Kenyan students pursuing higher education. These options include loans, scholarships, and bursaries, each with its unique eligibility criteria and repayment terms. Understanding the connection between these financing options and their impact on Kenyan students is crucial for informed decision-making and planning for higher education expenses.

Kenyans.co.ke on Twitter: "President Ruto plans to abolish the Higher - Source twitter.com

HELB financing plays a significant role in addressing the financial challenges faced by many Kenyan students and their families. Loans provide access to funds for tuition, accommodation, and other expenses, enabling students from diverse socioeconomic backgrounds to pursue their educational goals. Scholarships and bursaries, on the other hand, offer financial support to students based on academic merit, financial need, or other specific criteria, reducing the financial burden and promoting equity in higher education.

The practical significance of understanding HELB financing options lies in the ability to make informed choices and plan for repayment responsibilities. Students can assess their eligibility for different financing options, compare interest rates and repayment terms, and make decisions that align with their financial capabilities and career aspirations. Understanding the repayment process, including grace periods and repayment schedules, ensures timely and responsible repayment, avoiding potential penalties and maintaining a positive credit history.

Conclusion

The Higher Education Loans Board (HELB) financing options provide a lifeline for Kenyan students seeking to pursue higher education. Understanding the connection between these options and their impact on students' financial well-being, educational attainment, and career prospects is essential for informed decision-making and planning.

The availability of HELB financing reduces financial barriers, promotes equity in access to higher education, and contributes to the development of a skilled and educated workforce. It is crucial for students to explore these financing options thoroughly, make informed choices, and fulfill their repayment responsibilities to ensure the sustainability of the program and its positive impact on future generations of Kenyan students.