After some analysis and digging information, we put together this Kazakhstan Pension In 2025: Key Changes And What To Expect guide to help target audience make the right decision.

FAQ

Project 2025: Addressing The Social Security Sustainability Crisis - Source 2025fullyearcalendarpdf.pages.dev

As the year 2025 approaches, it is natural to wonder about the future of pension systems and the changes that may be in store. In Kazakhstan, several key changes are expected to impact the pension system, and it is essential to stay informed to plan for the future. This FAQ provides answers to help you understand the key changes and their implications.

Question 1: What are the key changes to the pension system in Kazakhstan in 2025?

The key changes to the pension system in Kazakhstan in 2025 include the increase in the retirement age for women from 61 to 63, the introduction of a new voluntary pension scheme, and the changes in the calculation formula for pension benefits.

Question 2: How will the increase in the retirement age impact individuals?

The increase in the retirement age will impact individuals by extending their working years. This may have implications for career planning, financial planning, and personal life decisions.

Question 3: What are the benefits of the new voluntary pension scheme?

The new voluntary pension scheme offers individuals the opportunity to supplement their retirement savings and potentially increase their pension benefits. It provides flexibility and tax benefits, encouraging individuals to take an active role in their retirement planning.

Question 4: How will the changes in the calculation formula for pension benefits affect individuals?

The changes in the calculation formula for pension benefits may impact the amount of pension benefits individuals receive. It is essential to understand these changes and their implications to plan accordingly.

Question 5: What steps can individuals take to prepare for these changes?

Individuals can take several steps to prepare for these changes, such as staying informed, reviewing their retirement plans, considering voluntary pension contributions, and seeking professional financial advice if needed.

The changes to the pension system in Kazakhstan in 2025 are significant and will impact individuals' retirement planning. By staying informed, understanding the key changes, and taking proactive steps, individuals can navigate these changes and secure their financial future.

Kazakhstan Pension In 2025: Key Changes And What To Expect

Tips

The article dives into the key changes to Kazakhstan's pension system in 2025 and provides insights into what to expect. Here are five tips to guide you through these upcoming changes:

Tip 1: Understand the New Contribution Rates

The contribution rates for employees and employers will increase starting in 2025. Familiarize yourself with these revised rates to plan your financial obligations accordingly.

Tip 2: Explore the New Voluntary Pension Savings Options

Additional voluntary contributions will be introduced to supplement your mandatory pension savings. Consider taking advantage of these options to boost your retirement savings.

Tip 3: Stay Informed About Changes in Retirement Age

The retirement age is expected to rise gradually in the future. Monitor any updates and adjust your retirement plans accordingly to ensure a smooth transition.

Tip 4: Plan for a Longer Retirement Period

With increasing life expectancy, individuals may retire later and have a longer retirement period. Start planning and saving now to support your financial well-being throughout an extended retirement phase.

Tip 5: Seek Professional Advice if Needed

Don't hesitate to consult with a financial advisor or other qualified professional. They can provide personalized guidance and help you navigate the intricacies of the pension system's changes.

Remember to stay informed and adapt your plans to align with the evolving pension system in Kazakhstan. This will empower you to make informed decisions and prepare for a secure financial future.

In addition to the tips provided, it is crucial to refer to official sources for accurate and up-to-date information on pension changes. The Ministry of Labor and Social Protection of the Republic of Kazakhstan (link provided in the article) is a reliable resource for further guidance.

Kazakhstan Pension In 2025: Key Changes And What To Expect

The pension system in Kazakhstan is undergoing significant changes in 2025. These changes are designed to improve the sustainability of the system and ensure that retirees have a secure income in their later years. Here are six key aspects of the changes to be aware of:

- Increased Retirement Age: The retirement age for both men and women will be raised gradually over the next several years. By 2025, the retirement age for men will be 63 and for women will be 61.

- Increased Contribution Rates: The contribution rates for both employees and employers will be increased. This will help to ensure that the system has sufficient funds to meet its obligations to retirees.

- New Minimum Pension: A new minimum pension will be introduced, which will guarantee a minimum level of income for all retirees.

- Increased Investment Options: Retirees will have more investment options available to them, allowing them to grow their savings and generate additional income.

- Improved Administration: The administration of the pension system will be improved, making it easier for retirees to access their benefits and information about their accounts.

These changes are expected to have a significant impact on the lives of retirees in Kazakhstan. By increasing the retirement age and contribution rates, the government is ensuring that the system is sustainable in the long term. The new minimum pension and increased investment options will help to ensure that retirees have a secure income in their later years. And the improved administration will make it easier for retirees to access their benefits and information about their accounts.

Kazakhstan Calendar 2025. Week Starts from Monday. Vector Graphic - Source www.dreamstime.com

Kazakhstan Pension In 2025: Key Changes And What To Expect

Kazakhstan's pension system is undergoing significant changes in 2025, affecting the retirement age, contribution rates, and pension benefits. These changes aim to ensure the long-term sustainability of the pension system and provide adequate retirement income for citizens. Understanding these key changes is critical for individuals planning their retirement and making informed decisions about their financial future.

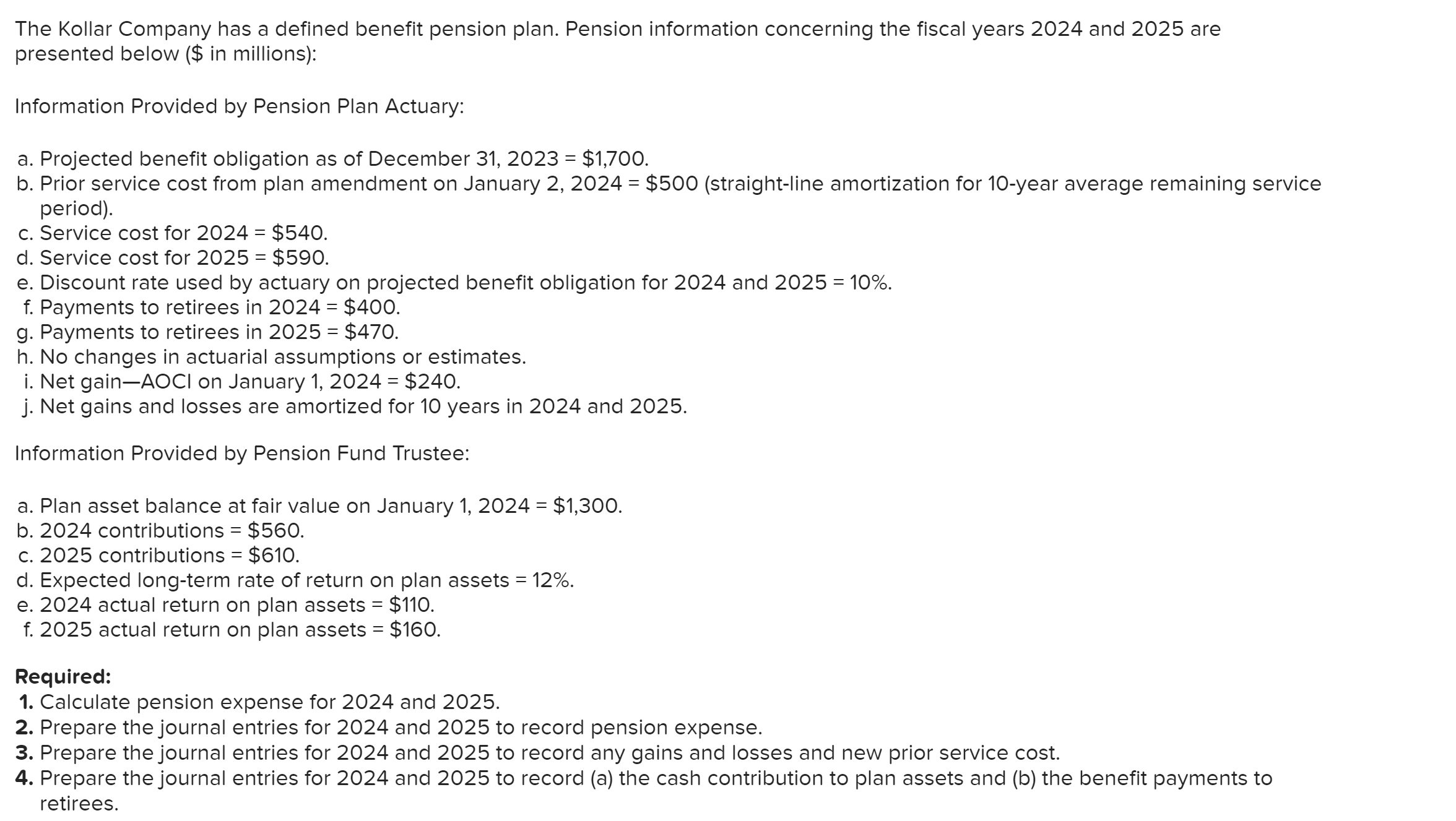

The Kollar Company has a defined benefit pension | Chegg.com - Source www.chegg.com

The most notable change is the gradual increase in the retirement age. For men, the retirement age will increase from 63 to 65 by 2028, while for women, it will increase from 58 to 63 by 2033. This change is necessary to address the increasing life expectancy and ensure the long-term viability of the pension system.

Another key change is the introduction of a new contribution rate system. Currently, employees contribute 10% of their salary to the pension fund, while employers contribute 5%. From 2025, the employee contribution rate will increase to 12%, while the employer contribution rate will remain at 5%. This change aims to increase the size of the pension fund and provide higher pension benefits in the future.

The calculation of pension benefits will also be revised. Starting in 2025, pension benefits will be based on the average salary earned during the last ten years of employment, excluding periods of leave. This change will ensure that individuals who earn higher salaries during their working life receive higher pension benefits.

In addition to these changes, the government is also introducing a number of other measures to improve the efficiency and fairness of the pension system. These measures include increasing the minimum pension benefit, introducing a voluntary pension savings scheme, and expanding the coverage of the pension system to include self-employed individuals.

The changes to Kazakhstan's pension system in 2025 are significant and will have a major impact on the retirement planning of individuals. It is important for individuals to understand these changes and make informed decisions about their financial future. By doing so, they can ensure that they have adequate retirement income and can enjoy a secure and comfortable retirement.